John Wang

@johnwang.eth

I attended the SBF trial. It was one of the most mind-blowing experiences of my life.Seeing him get a 25 year sentence today is as surreal as it felt sitting right behind him in that courtroom.Here’s my story of that day:

537

No replies to this section yet.

On Crypto Twitter, SBF was a larger than life character. I first texted him as a freshman Research Assistant in 2020 when FTX was getting started. He inspired me to join the Solana ecosystem in early 2021. Soon, Sam was the youngest billionaire in the world.

8

No replies to this section yet.

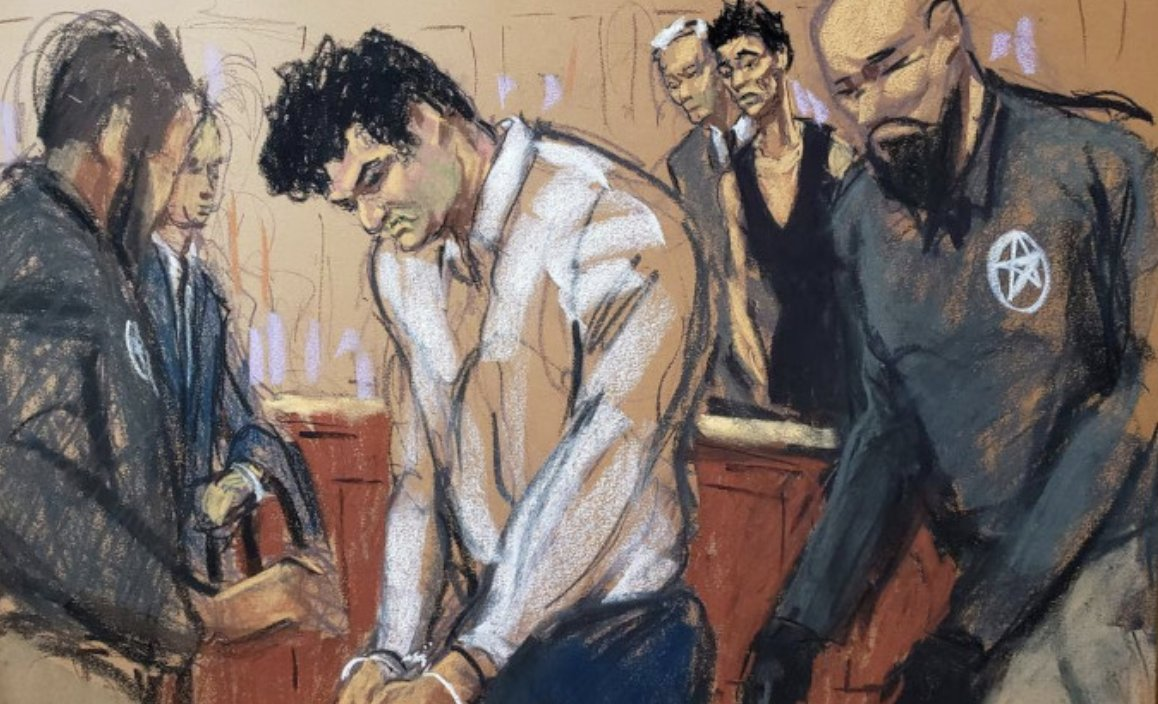

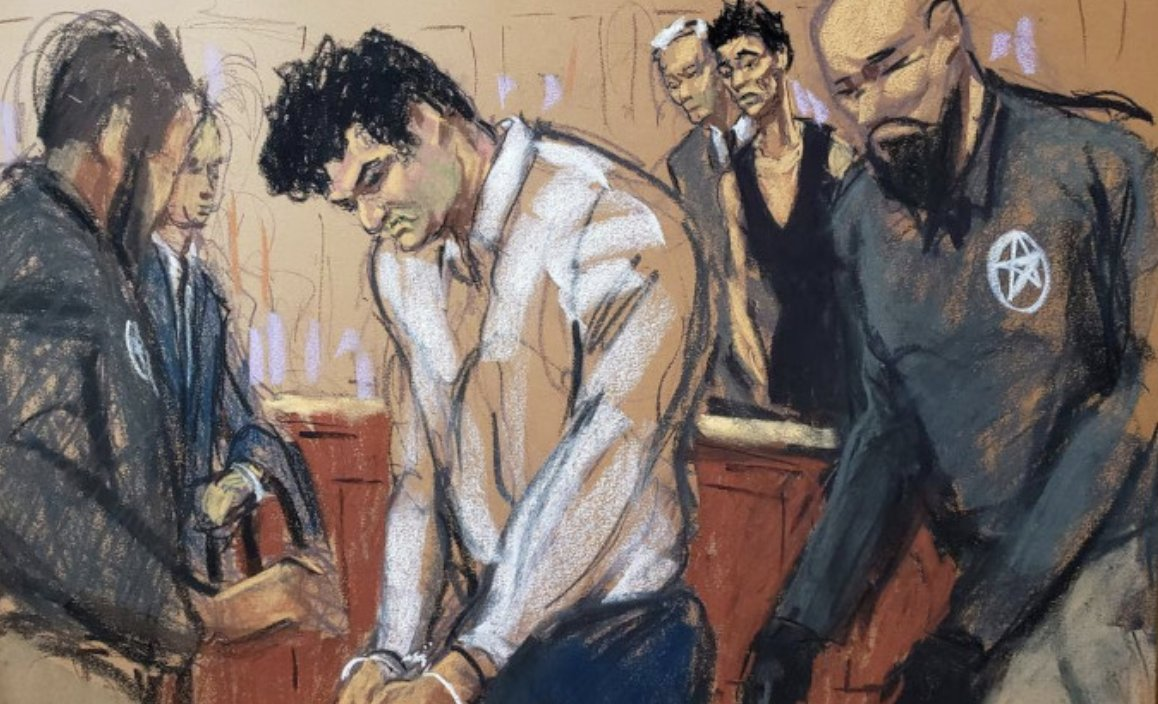

But sitting in the front row, all I saw before me was a meek, clenched, pale man -- smaller in stature than I expected.We briefly made eye contact before his eyes darted away and he lowered his head.

6

No replies to this section yet.

But sitting in the front row, all I saw before me was a meek, clenched, pale man -- smaller in stature than I expected.We briefly made eye contact before his eyes darted away and he lowered his head.

4

No replies to this section yet.

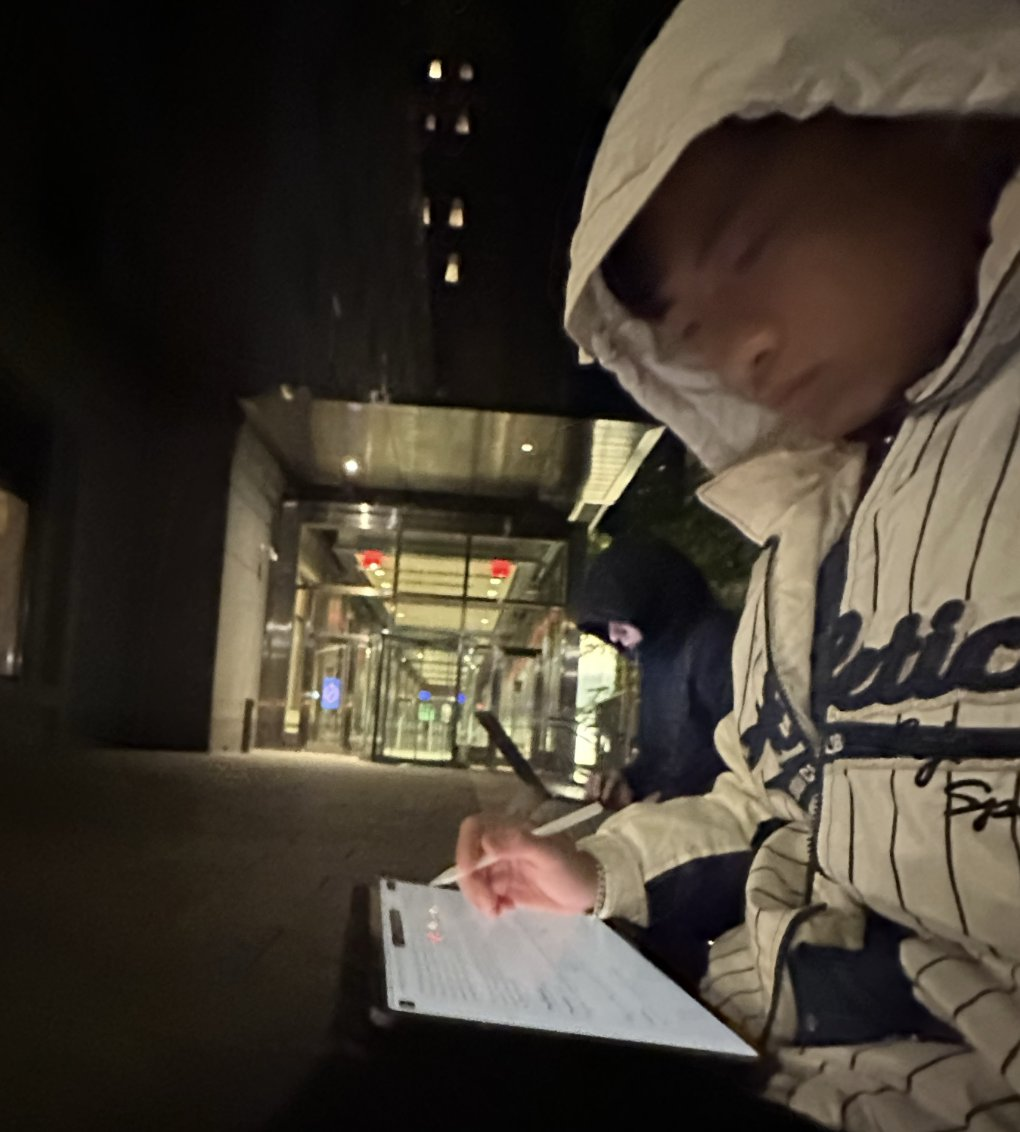

They only let 20 people in so I arrived at 4 a.m in the dark. The only other person before me was the NYT reporter who’d been rumored as the mouthpiece for SBF’s parents leaking facts. He was also the only journalist I saw talk to the parents.

9

No replies to this section yet.

The Trump case was happening simultaneously in the neighboring building. There were Secret Service agents, steel fencing, and black vans crawling the area at the crack of dawn. I waited 5 hours in the winter cold of NYC Financial District.

6

No replies to this section yet.

The courtroom was much smaller than I imagined. I exchanged ‘hellos’ with his parents who sat on the bench next to me. Film writers, sketch artists, and journalists eyed SBF like a zoo animal. Everyone stood as the judge walked in.

6

No replies to this section yet.

His lawyer pleaded the judge for adderall to stop SBF from shaking.The judge replied “I can’t be having lawyers coming in and feeding drugs to people on trial”, stirring up laughter among the journalists and furious head-shaking from SBF’s mom.

5

No replies to this section yet.

Today a huge witness testified: Nishad Singh, 3rd largest FTX shareholder and Director of Eng. He had signed a plea bargain with the FBI. He blinked tears as he got on the stand.“I participated in money laundering, defrauded customers and doctored financials to investors”.

4

No replies to this section yet.

“I’ve always been intimidated by Sam… [He] has physical twitches when he gets angry, grinding his fingers, closing his eyes, and grinding his teeth or tongue in his mouth… I was suicidal”SBF's parents squinted their eyes, pursed their lips, and coughed in protest.

5

No replies to this section yet.

The jury looked like NPCs randomly picked off the street. No-one looked younger than 40, half were obese, and some didn’t even bring a notepad. Lawyers had to explain every single crypto term. “When I was your age, mining was about getting rocks”, smirked the judge.

4

No replies to this section yet.

It was insane to see the face that once covered magazine front-pages and billboards in Times Square reduced to the butt of a joke. Outside the floor-to-ceiling window was a bright blue sky dotted with soft clouds. The contrast was sickening.

3

No replies to this section yet.

Jurors' heads turned back and forth between prosecution and witness like a tennis match, for 8 hours. I peeked at SBF’s mom’s notepad to see her notes but she was just doodling (lol).

5

No replies to this section yet.

The prosecution leaked SBF’s diary entry recounting a post-Superbowl party with Hillary Clinton/Kendall Jenner/Katy Perry/Dicaprio/Bezos. $1B in sponsorships (e.g. Steph Curry, Kevin O’Leary, and Tom Brady). The $30m Bahamas penthouse.Jurors chuckled at the opulence.

5

No replies to this section yet.

Going in that day, I hoped to give SBF some benefit of the doubt -- attributing negligence over malice. That faded quickly. Why?• SBF had singular control over the mixing of funds. He was the only executive with vested interests in both.

7

No replies to this section yet.

• Alameda had a $65B credit line, with the “allow_negative” backdoor code already enabled since July 2019

• SBF was still spending hundreds of millions right before their collapse (e.g. $TON deal with Telegram) wtf

• SBF deliberately inflated revenues by transferring SRM between entities

5

No replies to this section yet.

• SBF went to Middle East with Scarammuci to raise money after they already knew FTX was underwater

• FTX used straw donors for its political donations. Nishad: “you are [FTX’s] left face… give to a lot of woke shit”

• SBF didn’t code but “designed the technical and financial infrastructure for FTX”

4

No replies to this section yet.

Overall, massive fraud and no sense of bank accounts, employees, cash on hand, liquidity management, digital asset custody, cybersecurity practices, or any form of corporate control or governance

5

No replies to this section yet.

I departed the courtroom feeling empty, trying to process the gravity of what I'd just experienced.1. Crypto has very real and colossal consequences. Judge Kaplan had adjudicated cases involving: Trump, Prince Andrew/Epstein, and Al Qaeda terrorists. We’ve hit a scale where people’s life savings are on the line.

9

No replies to this section yet.

It’s not just memecoins, fun, and games. Normalizing negligence out of ‘degen’ culture is reckless. If we want to power a global financial system bigger than the current day crypto-native casino, we cannot lose sight again this cycle.

33

No replies to this section yet.

2. Seeing the jury made me realize how far we have to go in educating and onboarding normal individuals. Blockchain UX is still a joke.

3. It’s unintuitive for humans to grapple with the true magnitude of finance at scale. Small % errors can lead to hundreds of millions in accounting discrepancies.

18

No replies to this section yet.

4. Bring business back on-shore through sensible regulation. Coinbase is a trailblazer in long-term thinking.

5. DeFi is the answer. Build trustless systems where accounting is open, transparent, and verifiable by external parties.

30

No replies to this section yet.